Introduction

Client

Huru

Role

Brand & Product design

Industry

Financial Services

Insights

01

Everyone comes to the UAE with a dream, but the longer they spend here, the further they feel from achieving it.

02

People want to save more, but if money is accessible, it finds a way to get spent.

03

Everyone knows they should be doing more with their money, but will only trust something new if it’s recommended by their network.

User interview participant

Cleaner

Full money transparency

With everything money related in one place, customers can easily see all their accounts, transactions, and balances at a glance. This clear overview helps people stay in control and make informed decisions about their money.

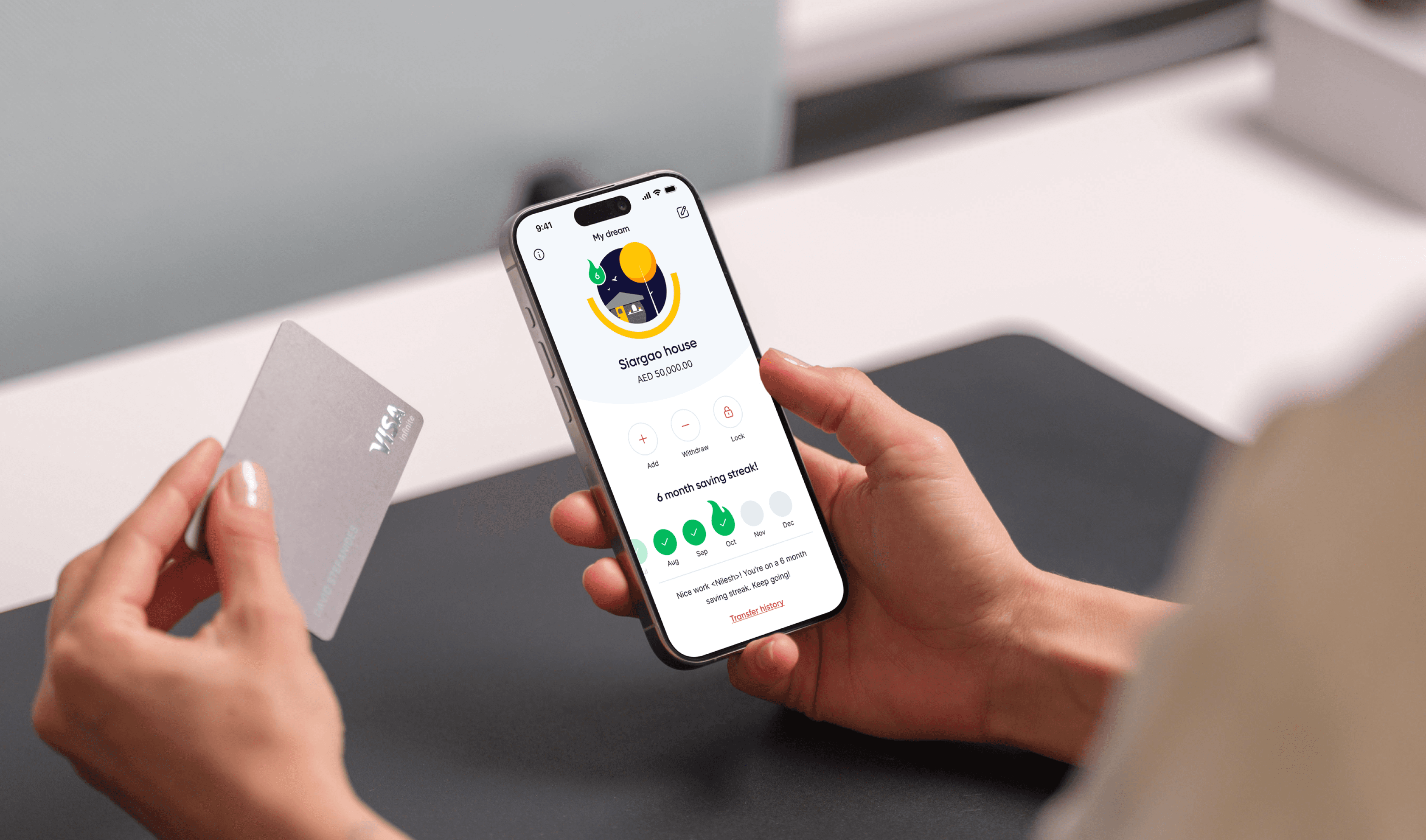

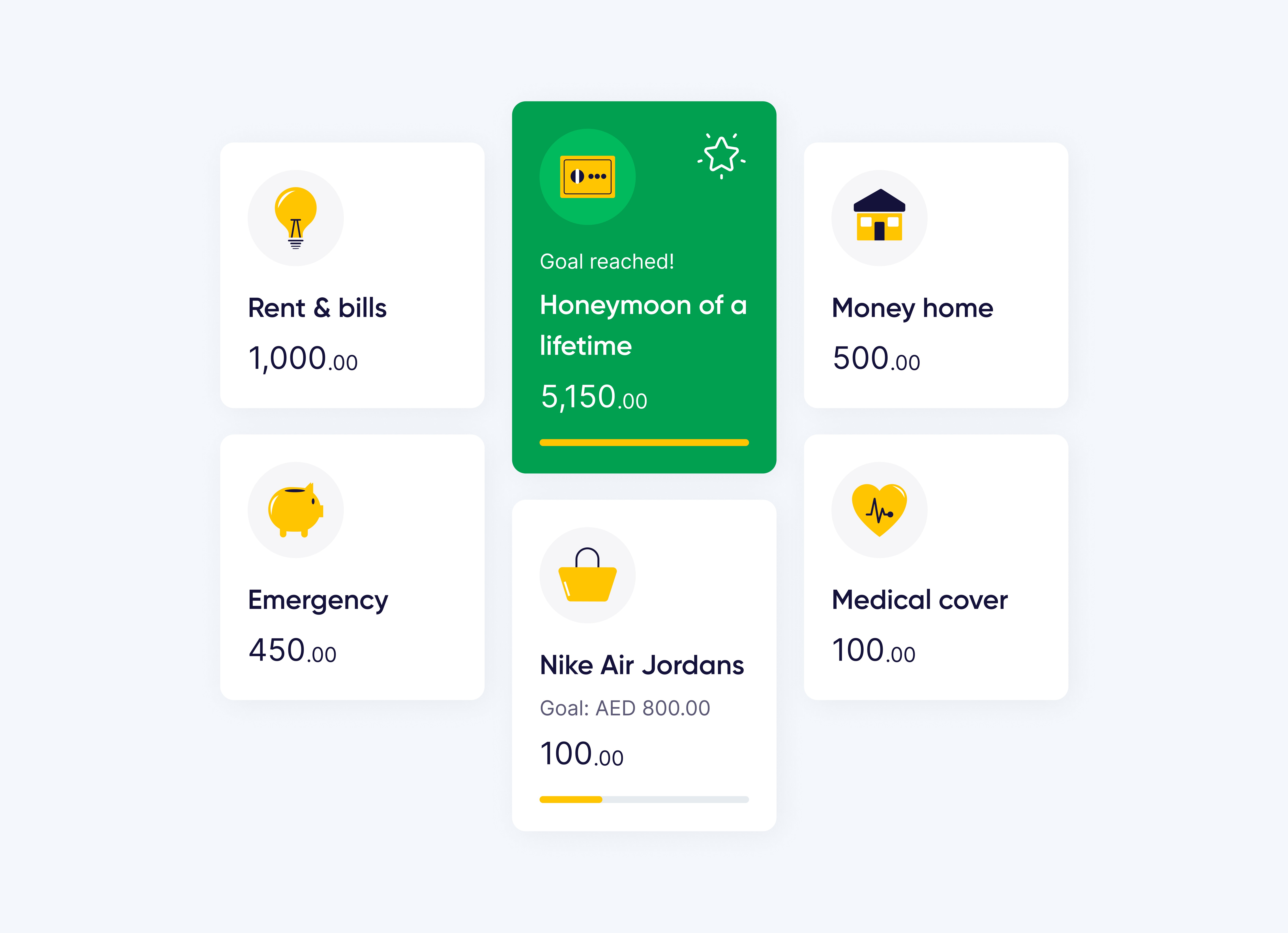

Accelerating progress

With no access to digital banking, a vast majority of the UAE have no way to earn interest on savings. This led us to develop a pot system that tapped into existing physical behaviours uncovered in the discovery phase. Pots help users effortlessly grow their savings and automatically allocates the interest earned to their dream. This system ensures that savings work harder whilst accelerating progress and bringing customers dream closer to reality.

Reducing the mental load

We heard that customers found remittance tedious so we set out to make it as simple as possible. Transparent fees, speedy transfers and a clear interface differentiates Huru in a crowded, complicated market.